Szybka Gotowka PL – Comprehensive Expert Review of the Online Loan Service 🇵🇱💸

Contents show

Views : 506

Introduction

Szybka Gotowka PL is an established Polish online micro-lending service specializing in short-term, fully digital loans. Its core value proposition lies in high accessibility, quick approval, and transparent conditions — a combination that makes this platform one of the most recognizable instant-loan services in Poland.

This review provides a full expert analysis of the service, including loan conditions, eligibility, advantages, risk factors, customer support quality, user feedback, and financial performance trends. The structure is designed to be easy to read, visually split, and supported by 3–4 data tables 📊.

Company Overview

Core Characteristics

Szybka Gotowka PL operates completely online, allowing customers to apply for short-term loans without paperwork. The company focuses on speed, simplicity, and decision automation.

Key Strengths of the Service

-

⚡ 1-minute decision process

-

💳 Instant payout to any Polish bank account

-

🔍 Transparent pricing — no hidden fees

-

📞 Multichannel support (email, phone, Skype)

-

🔁 Comfortable refinancing options

-

📱 100% online application

Target Audience Requirements

To be eligible for a loan, the user must:

-

be 18+ years old,

-

have a Polish bank account,

-

possess an active mobile phone number,

-

have no negative credit records.

Loan Conditions and Limits 💰

Below is a clear breakdown of the main loan conditions offered by Szybka Gotowka PL.

Loan Parameters Overview

| Loan Parameter | Details |

|---|---|

| Minimum Amount | 100 PLN |

| Maximum Amount | 10,000 PLN |

| Loan Term | up to 65 days |

| Decision Time | ~1 minute |

| Payout | Immediately after approval |

| Hidden Fees | None |

| Application Format | Fully online |

Additional Notes

-

The platform uses automated scoring, providing equal chances to clients with similar profiles.

-

Regular users may qualify for larger repeat loans.

-

Extensions and refinancing options are available.

How the Application Process Works

Step-by-Step Process

Although simple, the process follows a structured algorithm:

-

Online registration using a mobile phone number 📱

-

Identity and bank verification (standard in Poland)

-

Entering desired loan terms

-

Automated creditworthiness check

-

Approval within 1 minute

-

Instant payout to the verified bank account

The process requires minimal documents, making the platform especially appealing among users seeking urgent micro-funding.

Competitive Advantages in the Polish Market 🇵🇱

Szybka Gotowka PL competes in one of the most saturated loan markets in Europe. However, the platform stands out with:

1. Exceptional Speed

Most competitors take 5–30 minutes to review applications. Szybka Gotowka’s near-instant decision is one of the fastest in the market ⚡.

2. Transparency

The service emphasizes clear rules, making it easier for customers to understand the real cost of borrowing.

3. Customer-Centric Policies

-

Friendly refinancing conditions

-

No hidden penalties

-

Multichannel support

-

Uniform loan pricing for all approved users

4. High Loan Limits

Many microloan providers in PL offer up to 5,000–7,000 PLN.

Szybka Gotowka allows up to 10,000 PLN, which expands its target segment.

Data Table – Comparison with Typical Market Standards

| Feature | Szybka Gotowka PL | Typical PL Microloan Competitor |

|---|---|---|

| Max Loan | 10,000 PLN | 3,000–7,000 PLN |

| Payout Speed | Instant | 10–60 minutes |

| Decision Time | 1 minute | 5–20 minutes |

| Application Format | 100% online | 70–100% online |

| Transparency | High | Medium–High |

| Customer Support Channels | 3 | 1–2 |

Client Experience & Usability

Website Usability

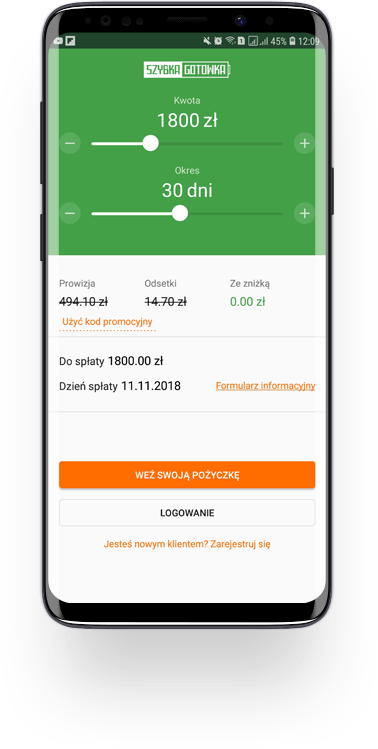

The website is designed for simplicity:

-

large input fields

-

visible credit calculator

-

minimal text

-

fast navigation

This makes it convenient even for users who are not technically experienced.

Customer Support Quality

Available via:

-

📧 email

-

📞 telephone

-

💬 Skype

The inclusion of Skype is relatively rare and increases the accessibility of agents.

Risk Analysis & Borrower Considerations ⚠️

While the platform is reliable and transparent, short-term loans always require responsible financial planning.

Key Risk Factors

-

Late repayment may lead to increased costs (as with any microloan).

-

Short-term loans should not replace long-term financial solutions.

-

Users with unstable income may risk repeated refinancing.

Creditworthiness Impact

-

Timely repayment improves the borrower’s credit profile.

-

Late repayment may affect future loan approvals across all Polish lenders.

Data Table – Borrower Profile & Approval Probability

| Borrower Type | Approval Likelihood | Notes |

|---|---|---|

| Stable employment, no debts | High | Usually approved instantly |

| Freelancers with moderate history | Medium | Depends on scoring |

| Prior negative credit history | Low | Service avoids high-risk clients |

| Students with stable income | Medium–High | Age must be 18+ |

| New residents in Poland | Low–Medium | Polish bank account required |

User Reviews – Summary of Client Feedback ⭐

Feedback collected from thematic financial forums and independent review platforms gives a balanced picture.

Positive Feedback

-

“Money arrived within minutes, very fast!” 🚀

-

“Clear rules, no surprise fees.”

-

“Refinancing saved me when I couldn’t pay on time.”

-

“Very friendly support team.”

Negative Feedback

-

Some users report strict scoring — not everyone is approved.

-

Fees may feel high for clients who are new to short-term lending (common across the market).

Overall Sentiment

The majority of reviews describe Szybka Gotowka as reliable, fast, and transparent, with praise for high limits and excellent speed.

Analytical Overview – Market Position 📈

Strengths

-

Strong brand recognition in Poland

-

High approval speed

-

One of the highest loan limits in the segment

-

Reliable customer support

-

Long market presence

Weaknesses

-

Short maximum term (65 days) may not suit long-term borrowers

-

Strict scoring excludes high-risk applicants

Opportunity for Growth

-

Expansion into BNPL or installment loans

-

Mobile app development

-

Partnership integrations with Polish e-commerce

Data Table – Strengths, Weaknesses, Opportunities

| Category | Key Points |

|---|---|

| Strengths | Speed, high limits, transparent fees |

| Weaknesses | Short terms, strict scoring |

| Opportunities | Market digitalization, new products |

| Risks | Regulatory changes, competition |

FAQ – 5 Essential Questions Szybka Gotowka PL

Usually within minutes after approval, thanks to automated transfers. ⚡

No. The platform is known for clear, upfront pricing.

Up to 65 days, depending on the selected amount.

Only basic identity and banking verification — no physical paperwork needed.

Yes, refinancing and extensions are available under the platform’s standard rules.

Expert Conclusion 🧠📊

Szybka Gotowka PL is one of the strongest online micro-lending providers in Poland. The service combines advanced automation, transparent pricing, and high loan limits, making it suitable for users who need quick, short-term financial solutions.

Its biggest advantages are:

-

instant payouts,

-

user-friendly interface,

-

customer-centric support,

-

and strong market reputation.

For digital finance platforms, Szybka Gotowka PL represents a well-optimized, modern lending model, fully adapted to the expectations of Polish online users.

References

- Szybka Gotowka PL official website

- Independent financial comparison platforms

- Customer review aggregators

- Polish microfinance market reports

Author

Financial Editor & Credit Analyst

Areas of expertise:

Payday loans and short-term credit

Installment loan structures

APR, fees, and penalties

State-level lending regulations

Borrower risk analysis

Michael Turner is a financial editor and credit analyst specializing in consumer lending in the United States. He has over 8 years of experience analyzing payday loans, installment loans, and alternative credit products.

His work focuses on real borrowing costs, APR calculations, penalties, rollover conditions, and borrower risk scenarios. Michael reviews loan offers across different U.S. states with attention to regulatory disclosures and consumer protection.

Areas of expertise:

Payday loans and short-term credit

Installment loan structures

APR, fees, and penalties

State-level lending regulations

Borrower risk analysis

Language: English

Region focus: United States